Free Download Taxact Software

I was able to lock-in a very good discount of $7.50 for federal and $12.50 for state ($20 combined) on April 15 by doing this. That's still the highest I ever paid for this ($12.99 was the lowest). I procrastinated, and finally started re-entering everything into TaxAct last night, October 15 in order to file for my overdue refund.

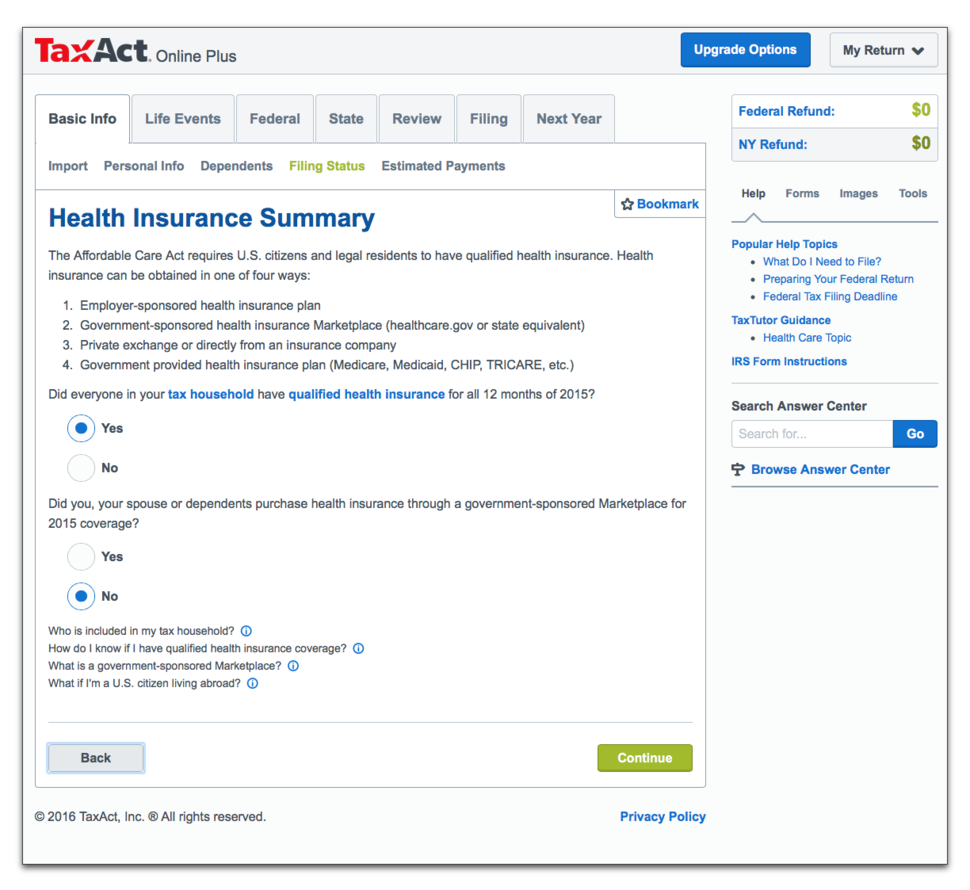

Would you believe it, for the first time ever, I found a ridiculous math error in TaxAct? That's worse than Credit Karma, which at least got the numbers right, even though it didn't put them all in the right boxes! This error is in the Asset Depreciation form for straight-line 39-year (non-residential) property. It's a simply the original cost divided by the 39 years, and TaxAct's answer is wrong! It stands out since it doesn't match the prior year as it should.

Even better, if I change the starting year for acquiring the asset (still in a past tax year), the annual value to deduct also changes slightly. This is supposed be simply $150,000 divided by 39 to equal $3,846, but somehow TaxAct is giving me $3,838 and $3,842 instead!

Prepare & e-file your Federal and State tax returns on your smartphone starting for free - anywhere, anytime. Just answer a few easy questions - TaxAct Express does the rest. Secure e-file + direct deposit for your max IRS refund the fastest way possible. Key Features: * Personalized product. Compare tax software and find the best alternative to TurboTax. Federal filing is always free on FreeTaxUSA.

It's like the controversy time long ago when Microsoft's Windows 3.1 calculator utility had a bug where it gave incorrect answers. WTF (a computer that can't compute)!

I reproduced this issue on a new empty tax return with nothing else entered but this item. It's clearly a ridiculous bug! This problem is going to surprise a lot of people in years from now when they one day sell their property and find their accumulated depreciation from tax years 2016 onward are deficient! I'll bet TaxAct won't cover the losses than either under their accuracy guarantee when the time comes. TaxAct also inexplicably limited me to just 5 additional lines on my attached statement to expand a form, even though the actual statement page generated has 27 blank lines! I guess this year's motto for TaxAct is higher cost for lower quality product.

First time I ever saw an error in TaxAct, so it's embarrassing. Luckily, I caught the error in review, and since this problem is only visible on an internal worksheet that doesn't get filed, so I was able to fudge the numbers to get the proper final result onto the actual form, filed the return that way.

I'm planning to call the TaxAct support team next week after 2016 e-Filing closes about these problems (they don't have Email support anymore?), as I figure that they should have a some free time by then to really look at it. Hopefully it'll be fixed in the 2017 version that way, if they are not already aware of it (I'm expecting that they are aware, but not going to proceed entirely on that assumption). Bottom line - be careful with any tax prep software, check their work very closely if you can! TaxAct definitely had some issues this year, hope next year will be better. TaxAct does still have the free 1040 Preview without paying, however they moved it and it's pretty hard to find now.

I found it by accident only now after the fact, looking for how to print my fee receipt! I called support and they were of no help. They ask me for my user name and email which I supplied. They asked for my address. I gave this information. Then they ask for my name on the account.

At this point I am thinking you can download the software to your desktop. Why do they need this information. I am not going to e-file it through them nor am I going to submit the return online. I am going to mail it in. I pay for the product with the business capability.

End of transaction. It should work or they have a faulty product or they try to micro manage too much. They seem to want you to file online. I asked for a refund and they sent me notification that it may take up to 2 weeks.

I paid the price they asked for the product. I should have gotten an unlocked product or the very least the unlock code should work. If there was a secret to using the unlock code they should have told me the procedures or provided it in the instruction. There was no need to call them.

It is difficult to find the phone number for them as they want you to use other avenues first. Contact us link is misleading. With the information I gave them they are able to reverse the charges but would not provide help in solving the unlock problem. I have used them for 8 years and never had this problem. I never had to unlock the downloaded version.

I paid for the program and that's it. If it's a desktop product then it should work. I believe that their problem is they focus too much on trying to get the customer to file online. They offer downloads but they make you work for it instead of keeping it simple simon.

I filed a State Return for New Mexico with TaxACT Online in 2016. After filing, I received a notice from the State of New Mexico saying that I owed them money. This was after I was told I would receive a refund. I contacted TaxACT and they would not help me resolve the issue. It wasn't until after I threatened to file a complaint with the BBB and the attorney general's office that they responded.

3 months later I received an email that they had made a mistake on the return and I do have to pay the money. I will never use this program again. The TaxACT service makes it appear as though your taxes are being paid through them.

I e-filed my return where it asked for my credit card for the $15 payment for using this so-called service. When I receive a notice that my federal return has been accepted, and receive emails saying my taxes have been filed and my return accepted one is led to believe that the taxes were paid.

Hidden multiple clicks after finding out your e-filing has been accepted is the location where you can pay your federal taxes. Providing this link on the same page as e-filing would make sense, but this program doesn't make sense. After not receiving my refund by the end of February, I contacted TaxACT after finally finding a customer service number and asked what was going on. They stated that there was a 'glitch' in the electronic submission of Form 8885 (yes, the stupid ACA-Obamacare form) and that they had to re-submit on February 13th. They never once contacted me to notify me of the error or the delay. When asked why, they said it was a minor error and everything would be fixed and my refund received in a couple days (first week of March).

After not receiving my refund in the first 2 weeks of March, I contacted the IRS only to discover that TaxACT failed to inform me that their error would set my refund back for a minimum of 6-weeks as the IRS had to reprocess the forms manually and that I should have my refund by the end of the 3rd week of April. I contacted TaxACT regarding this and they said that they only 'just received the same information' and apologized for the delay. I demanded a refund of my filing charges and after arguing with me and finally getting a manager, I got my refund issued. April has come and gone, so I called the IRS back. After an hour on hold, and being hung up on one time before, I was told that my return was still in their errors department and nothing had been done with it. They assured me that this time, they would get it out of that department and fast-tracked for refunding. But it would take an additional 30-days for processing (but would likely be sooner).

Nothing more could be done until then. Today is day 29, and still nothing. I am again still on hold with the IRS waiting to find out where my return is. It is likely still stuck in their black hole of 'errors' and I will be told to wait another 30 days. ALL BECAUSE OF THE DISHONESTY AND POOR CUSTOMER SERVICE OF TAXACT!! Never again will I do business with TaxACT due to this issue. They have officially lost a long-time customer and supporter.

And after reading the many similar situations on ConsumerAffairs, I believe a class action lawsuit may be in order due to the gross negligence and abuse of the TaxACT company! If any law firms pick this up, please contact me as I wish to file my complaint and use my case as a lead in this situation! I've been a TaxACT customer for many years.

I loved the value for the product that I was getting but this year has been a nightmare. I was looking to download the software like I have in previous years but couldn't find a way to do that so I wanted to call someone for help but the phone number was nowhere to be found. Requests had to be done through email and it says 2-3 business days to respond. It's supposed to be tax season. I was running out of time and I had to do two returns and paid twice for them. I had no choice at the time. There was no other option for this.

This will probably be the last year that I stay with them. I feel so scammed. If they respond and return my funds I will update this review and let you know what they say. I received a letter from the IRS asking for an explanation on how we calculated line 73d on form 1040.

So I looked it up to see what the heck it was and it apparently is a request for a refund for a prior year overpayment on taxes! We owe the IRS taxes so where the heck did TaxAct come up with any amount of a refund from a prior year - especially since we had never filed out taxes through them before? They are phony and pad your returns to make it seem larger so you will go with them and then BAM!

Few errors I found in TaxACT software this year 2016. First, there is no question to fill up the right way for Non-custodial info in the Form 8332 (Release/Revocation of Release Claim to Exemption by Custodial Parent). Their system reflects the same name of custodian to the non-custodial part. This should be able to input the name of non-custodial where you would release the exemption to.

I ended up getting the form at irs.gov website and manually do it the form. It would take time for me to resolve this issue because there is no live support or call numbers to call to. I can't believe it!!! Secondly, the e-file didn't go through and requested me to delete the 1 dependent because other person claimed it already. How would the system went through that logic if I filed 8332? It should went through.

Lastly, when I try to fix the errors I can't log in and it says multiple attempts had been made. I tried the password to change but the questions seemed not familiar.

This is surprising because I slept and when I wake up I continue what I have been left off. No change of password for sure. As I said, no live support to call for immediate action. I ENDED UP FILING my return to paper mail. This is what I paid for $85.

Good luck for those who come back for this unforgettable experience. I should ask for money back. Horrible experience. I had used them for '14 and '15 taxes which were pretty complicated and had partnership income.

OK then, if a little clunky with the Q and A format. This year should have been super-simple (could probably do it by hand if I had the patience). But what a nightmare! It's like a totally different service. Very slow on the 16th and 17th of April.

Then when I tried to file electronically (or print) on the morning of the 18th the whole system crashed. It first tried to sneak in a $79 'audit protection' fee. When I declined, and just went with the $37 option, it would not accept payment, so it would not send the return off to the IRS. Worse, the screen froze. The back button was inoperable.

I had to go back to the very start of the Q and A nonsense to try the payment again. Failed all morning. So ended up filing an extension (first in my life), and will try tomorrow. Pop Goes Punk Full Album Download.

I keep seeing on TV all these tech companies talking about the cloud and 'scalability'. How they can handle even the heaviest volume with no problems. I gives TaxACT isn't a client.

They should issue a warning: use us before April 10 or be sorry! Another problem: there is no place to deduct tax prep fees. Or investment expenses. I left those off since I had more than enough deductions, but still, it was not even covered in the Q and A. Or in the help topics. I remember last year's version was much more comprehensive.

Oh, the customer help number? Fast busy signal since the 16th. Price increase! I've been using TaxACT for more than a decade. I've always found it to be a good product and I've used it year over year to file my state and federal taxes. This year, though, was a shocker!

I use the desktop version because, in this day and age, I don't want my tax information stored 'in the cloud'. When I downloaded the software this year I was charged $121 whereas it cost me $35 last year. Over time, the increases have been reasonable. This year is an abomination.

Surely the convenience of not having to re-enter all of the information from preceding returns is worth something but after this I will certainly be using a different product for next year's tax returns! TaxACT is price gouging - I've been with them for years and I don't know if it was the coffee this morning that made me take note or the fact that they have changed practices, but my filing this year cost me $75 and here's why. I've been with them for years, they pull my info from prior years nicely. This service is $10 and I appreciate it and happily pay it. To file the state section it's an additional $38, OK I can deal with that.

This year I hit $75 as I was forced into the more expensive product at an additional $37. The price gouging scheme works as follows: they pull my prior info, that prior info has a tax form from my prior refund.

In accordance with the law, I'm required to include my refund from the prior year in my taxable income for this year - makes sense. What doesn't make sense is that I need to purchase the more expensive version of their software this year to tack on an additional $700 in refunded income from the prior year's return. Are you kidding me? You're forcing all users who filed a return through your service through the more expensive product with this requirement and its price gouging.

My situation represents a typical use case and I can't stand that this just happened. You save data that you know you'll be forcibly using against me with no way out other than paying a premium to stay within the letter of the law - I utilized 0% of the product you just made me purchase through this aggressive policy setting, targeted at taking advantage of the 100% typical US citizen. $75 for a return is beyond nickel and diming and I've had the worst experience with this company.

Notes for star ranks below: impossible to locate a contact us on the site without fully logging out and navigating to the home page and sifting through their FAQ's until I can find a point of complaint entry. Ease of use is low - you are corralled into their pricing schemes which is not user friendly. Accuracy is low - you are misrepresenting your services and charging $37 additional dollars for 0% of the purchased product - if I break that down more accurately, you are charging for 1 of likely 200 aspects of use of the more expensive product. So maybe I'm getting.05% use of this product which DOUBLES your cost to file. I am totally dissatisfied with TaxAct! First of all, I saw an ad that they changed the price from $30.00 to $33.00. Secondly, by the time I finished, and got ready to submit, there was a $37.00 charge for the federal return, and $38.00 for the state return.

Also, just to transfer the money into my checking account, the bank charges a $28.00 fee!! I am a senior citizen, and I feel like I've just been fleeced!!! So, I decided not to have the money automatically deposited, so I won't have to pay the bank fee!! This is just wrong!! I may as well have paid someone to do the filing for me!

I received the following in Nov. 2016: 'You only have 3 days left to access our exclusive Cyber Monday offer! Lock in your 30% off TaxAct 2016 Plus Edition today! As always, your low price is guaranteed no matter when you file.' I locked in my price as directed. Then a short while ago I received the following: 'Simply sign in to your TaxAct Account. Your username is: **.

Open your return to guarantee your 50% savings on your already low locked in price! Your discount will be applied at check-out. E-file your return and enjoy your savings!' But they refused to honor the 50% savings. Their reason why: 'We are only able to apply 1 promotion to each return. The 50% promotion is for half off of the regular price of the Federal return. The $10 promotion that you currently have is a lower price than the 50% promotion off of the regular priced Federal return.'

But the promotion says 50% off 'already low locked in price' not off the regular price. They make it extremely difficult to determine pricing and send out so many special offers to further confuse the issue. The amount of $$ is insignificant.

My concern is just their unwillingness to honor the promotion they sent to me. DO NOT TRUST THEM. I certainly won't in the future. Although I have used TaxACT for the last couple of years and it has done a good job on my federal taxes, I have to give it a failing grade on state taxes. It did not identify that I actually did not even need to file an Oregon State non-resident form because my income was under the designated threshold. Therefore, in 2015 I filed when I didn't really need to and it cost me about $50. I almost made the same mistake this year but I happened to go to the state directions myself and noticed that I did not even need to file.

This mistake would have cost me close to $100 this year. The income threshold should have easily been identified by TaxACT.

I feel like perhaps TaxACT is intentionally programmed to allow tax filers to file state taxes when it is totally unnecessary, so the company can collect the extra fee for filing state taxes. I've been a loyal client of this company for a number of years, but all that changed today, April 16, 2017 year when I filed my tax return. I was expecting the same customer experience and similar pricing, but little did I know that TaxACT has transformed from a company whom I trusted and respected into just another ripoff service. The first sign I should have figured out something was amiss was when there's this new charge of $10 to import last year's tax information.

It was a minor annoyance, but I paid the $10 and imported my taxes. So far, so good, right? I proceeded to complete my taxes, and because my return is fairly simple, I just assumed that I would pay $15 or $20. All of that changed when I went back and added some gambling winnings I forgot to include.

When I entered gambling winnings, the scenario suddenly changes when a pop-up appears and indicates that I need to upgrade to the $37 edition because I added a form. No problem, so I proceed to pay the $37 and continue on my merry way. I proceed print off my federal form, but it occurs to me that I wasn't given the choice to print my state return. So, I go back and check the box to print my state return and another pop-up suddenly and indicates that I need to pay an additional $38 to print my state return. Now, I realize that I'm being sucked down a rabbit hole, but still think it's a mistake because I trust this company. So, I proceed to contact TaxAct and explain the situation to the representative.

To my surprise, she informs me that it isn't a mistake and that's what I'll have to pay. I inform her that last year, I paid $9.99 and $6.00 for filing my federal and state taxes, respectively, and ask her what is the reason for the dramatic price increase. She couldn't offer me an adequate explanation, other than the prices had increased. Now, I'm a reasonable person and I don't have a problem with companies increasing their prices from time to time if it's reasonable.

But, to increase the price for a generic service from $15.99 to $75 is a total rip-off. It reminded me about how the drug companies are ripping off customers. Now, if there was something unique or proprietary about their product, I might be able to understand a moderate price increase. But, a five-fold increase is unwarranted and unconscionable, and I don't understand how this once trusted company can justify ripping people off to this extent. Waqt Movie Video Songs Free Download. Because today is April 16, and I don't have time to look at alternative providers, I chalked it up to a lesson learned.

But, it's sad to see a company that I trusted for so many years turn into just another rip-off service that has designed its software to knowingly lead customers down a rabbit of paying more and more fees. Had I known upfront that I could potentially being paying up to $75 for a simple return, I never would have went down that rabbit hole.

Good luck, TaxACT. You have lost me a client for life.

Basically, they shut down tax day and set up ways to make contacting them very complicated. Use a company with available customer service and active tax day. I went to submit my tax return with your company on tax day. I work overnight shifts and your website shut down mid application on tax day. I attempted to contact you and the process proved you do not want to interact with your clients.

It was a grueling process and now I have the privileged of applying with another company since tomorrow is Easter after-all. 90 minutes of submission with your company amounted to being shut down and having to do it all over again with another company.

I had to send an email from 3 different emails to get one to go thru with my complaint although it took one email address to start my taxes. I would have been better off obtaining paper documents and submitting my taxes. No response has seemed necessary by your company and that there is no contact phone number. An alarm I should have recognized early on. When a company does not give a contact phone number. If you are not satisfied there is no customer service to talk to!!! Wow, I was a huge fan of your tax software for 5 years.

This year I even convinced my son to use it, boy, I wish I had not. You've ruined a great user interface and experience. I will hunt down every site that allows feedback and make a point of complaining about the CRAP you've passed off. I can't believe I've wasted so much money trying to get a simple federal form completed. NEVER AGAIN, and I would give zero stars if that were an option. TurboTax or H&R Block are better and actually would have cost me less. I guess you guys are planning on getting out of the business altogether?

You must be because I've not read a single review positive review that wasn't generated by some half talented marketing person. Why on earth would piss so many people off with this wretched piece of garbage?

I sincerely wish I had read these reviews before filing. But who can know, if you have been a long time customer. I don't even know if my taxes have been filed. The navigation was fine until the very end.

It directed me to a third party to obtain my refund. By the time it was all said and done, I owed $103.00 to TaxACT/Third Party. I have never been charged this much, even with the Online Plus. I am sure TaxACT does not care that I am never using their services again.

But looks like you will be losing more customers and for that, I am glad. For the lady, who was left with only $50.00, I am so sorry, I would have rather given you my $103.00 than this now gone RIP-OFF Software Program. We may never get a refund on the money unfairly took, so to TaxACT and Third Party, enjoy my money, that's the Last DINERO you will get. Hasta La Vista Baby!!!

I waited until two days ago to prepare mine and my husband's taxes and mistakenly thought the fee would be the same as my friend. Nothing was noted about price during the whole process of filling in our forms but I stupidly assumed that the fees would be $40.00 as my friend paid two months earlier for the same exact type of return.

Well when the program got to the point where I needed to make payment, that $40.00 went up to $75.00 ($37.00 for Federal and $38.00 for State)! I didn't even think to check the pricing after only a two month period and on not one of their pages did it even state the pricing. I don't remember the initial link I clicked on to log into TaxACT but I know that it didn't state this new pricing. At that point I wasn't willing to start over again with another tax filing service and reluctantly paid the $75.00.

I'm sure TaxACT hopes everyone does this. It's pretty crappy that they almost double their fees within two months for the same year's filing (they probably feel that they can gouge last minute filers)! I won't go back to using Taxact again!

TaxACT launched in 1998 and has grown to become the second most popular tax software program available. For the past seven years, TaxACT has maintained its number two spot, providing tax preparation and filing services to more than 38 million customers. • Economical: TaxACT is a great solution for money-conscious consumers. The company’s top of the line package, the Ultimate Bundle, only costs $21.95 and includes federal and state return filing fees. • Transparency: TaxACT prides itself on its transparency – there are no hidden fees or gimmicks, pricing is straightforward and available upfront.

• Mobile app: Customers can download and save documents using the new TaxACT mobile app. • Interface: TaxACT is one of the more cumbersome products on the market and customers with a complex return may be better off spending a little extra money to save both time and frustration. • Customer service: Customers that need tax help or assistance troubleshooting a problem will have to make a long distance call as no toll-free number tech support number is available. • Best for: Individual and Basic Filers, Families and High Income Individuals, Sole Proprietors. Your use of this site constitutes acceptance of the Advertisements on this site are placed and controlled by outside advertising networks.

ConsumerAffairs.com does not evaluate or endorse the products and services advertised. See the for more information.

The information on this Web site is general in nature and is not intended as a substitute for competent legal advice. ConsumerAffairs.com makes no representation as to the accuracy of the information herein provided and assumes no liability for any damages or loss arising from the use thereof. Copyright © 2017 Consumers Unified LLC. All Rights Reserved. The contents of this site may not be republished, reprinted, rewritten or recirculated without written permission.